keyboard_backspace

Our Service

We're here to help. If you would like to get underway today, just click the relevant link below or Free Call Us on 0800 466 784

According to TMM Magazine, nearly 80% of new mortgages in 2025 were either floating (30%) or fixed for just 6-12 months.

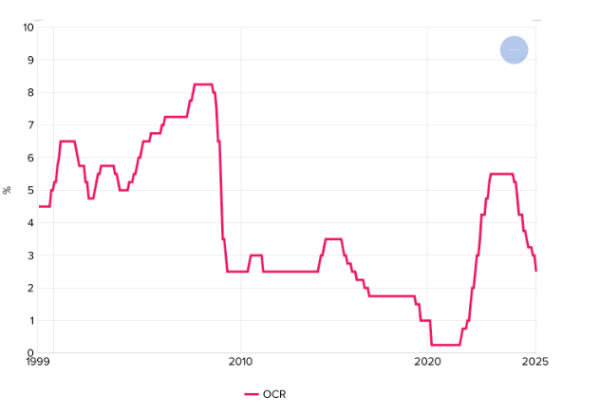

As interest rates dropped (see the OCR graph below), many borrowers opted to stay nimble, hoping to benefit from further drops.

Source: rbnz.govt.nz - Past monetary policy decisions

But while short-term and variable rates offer flexibility, they also come with risk. No one can predict where interest rates will go next, so it’s important to have a plan that works across multiple scenarios.

That’s where an appropriate mortgage structure comes in. Our Mortgage Link advisers can help you through your options, so you can build a loan structure that balances flexibility with foresight.

July 2025 marked one year since the introduction of debt-to-income (DTI) restrictions. For owner-occupiers, the new borrowing limit sits at six times their gross income, or seven times for property investors.

After reviewing the impact of DTIs, and to encourage access to finance, the Reserve Bank has recently adjusted another key set of rules: loan-to-value (LVR) restrictions.

From 1 December 2025, banks can lend:

What does this mean for you?

If you’re entering the market with a smaller deposit, it may be slightly easier to get bank approval – as long as your income, credit, and other factors stack up.

Not sure where you stand? A Mortgage Link adviser can assess your situation and help you explore your options.

According to independent economist Tony Alexander, it’s still a buyer’s market out there.

With property prices largely steady and listings on the rise across NZ, first-home buyers keep driving demand.

Heading into 2026, the window of opportunity is still open. Buyers who are financially prepared will be best placed to take advantage, and your Mortgage Link adviser can help you get there. From pre-approval to tailored mortgage structures, we’re here to make sure you’re ready when the right home comes along.

Whether you’re buying your first home, refinancing, or just want to revisit your structure, Mortgage Link is here to help.

Get in touch with your adviser today, and let’s make sure your mortgage is working for you in 2026 and beyond.

Disclaimer: The information provided in this article is intended for general informational purposes only and does not constitute financial advice. Every individual’s financial situation is unique, and financial decisions should be made based on your specific circumstances and goals. We recommend consulting with a qualified financial adviser before making any investment, insurance, or mortgage-related decisions.

Please visit https://mortgagelink.co.nz/available-disclosure/ for more information and Disclosure information.